Empower your investments with just a tap.

Crowdfund your way to success!

Empowering investors

Empowering Innovation Through Smart Investment

iMowazi operates as a securities-based crowdfunding platform designed to connect Kuwaiti businesses with a range of investors. The platform facilitates various crowdfunding opportunities; however, it is important to note that iMowazi does not endorse any specific projects or investment opportunities presented on its platform. Furthermore, iMowazi does not provide support for the growth or development of the companies listed.

Investors are advised to conduct their own due diligence and assess the risks associated with any crowdfunding opportunity available through the iMowazi platform. The inclusion of any business or project on the platform does not imply endorsement, recommendation, or guarantee of investment performance. Users of the platform should be aware that all investments carry inherent risks, and past performance is not indicative of future results.

Empowering Investors

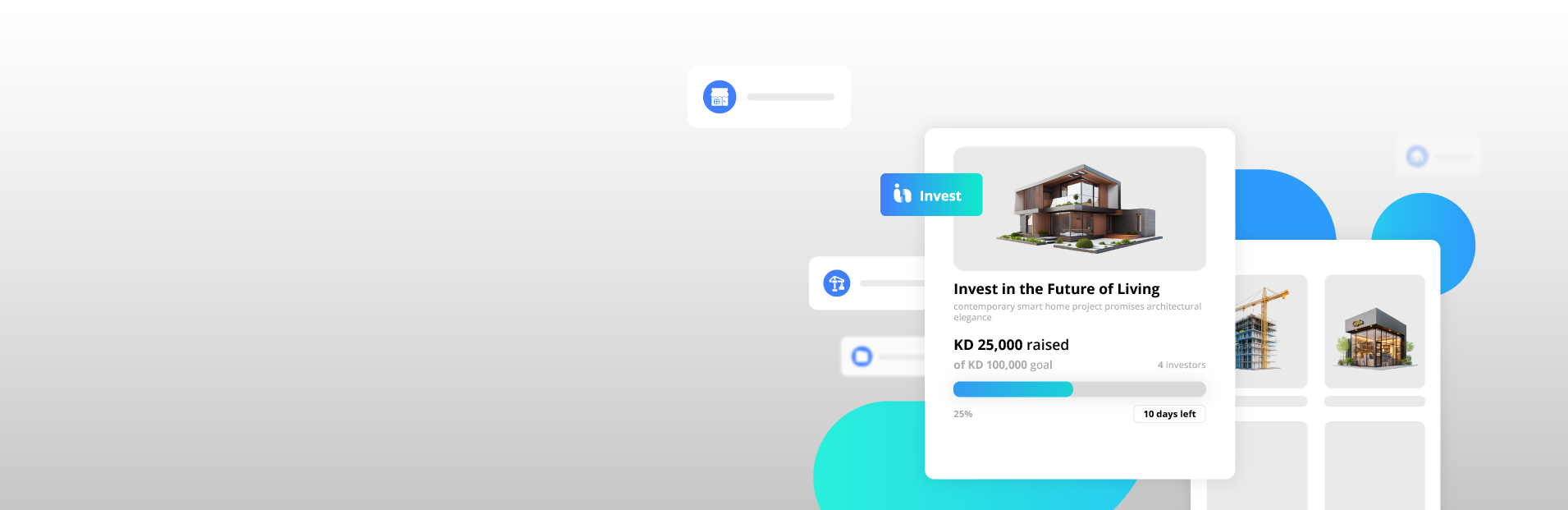

Invest Smart, Raise Funds Seamlessly

Total Investments

Number of investors

13

Active opportunities

17

IDEAS INTO REALITY

What is a Securities-Based Crowdfunding Platform?

Our securities-based crowdfunding platform is a modern online market place where businesses can raise money from a variety of investors.

This allows established and other privately owned companies to connect directly with potential investors, making it easier for them to get the funding they need and giving investors crowdfunding opportunities to invest.

Regulatory Compliance

Transparent Due Diligence

Diverse Investment Opportunities

Accessibility

Everything you need to know

Frequently Asked Questions

While the platform operates under regulatory oversight, investing in any businesses carries inherent risks. Many companies fail, and investors may lose part or all of their investment. It’s recommended that investors conduct thorough due diligence on the companies they are considering.

The amount an investor can invest per year varies based on a number of factors such as including income and net worth and is done to protect investors.

Evaluate crowdfunding opportunities by reviewing the company’s business plan, financial projections, competitive landscape, and management team. Look for transparency in disclosures and assess the risks involved. Engaging with independent advice or financial professionals before investing can also help.

Yes, investors have up to 5 days after the project's conclusion to reassess their decisions. If an investor chooses to withdraw all or part of their previously invested funds during this period, they must submit a written request to iMowazi.

To be eligible to raise funds through iMowazi, a company must be registered in Kuwait, have an authorized capital of at least KD 50,000, and meet specific legal criteria. For more information, please refer to the section titled "Do I Qualify for Crowdfunding."

Typically, any private companies looking to raise capital can utilize securities-based crowdfunding, including small businesses, and real estate ventures. However, they must meet specific regulatory requirements and eligibility criteria.

Yes, a company can cancel a crowdfunding project after it has begun. However, it is required to communicate the cancellation using the same method as the original announcement.